Warsaw, 31 March 2022

Memorandum of the Union of Entrepreneurs and Employers (ZPP) on the economic situation in Ukraine and its consequences for Polish companies

On 24 February 2022, the Russian Federation invaded Ukraine. Hostilities spread over almost the entire territory of our eastern neighbour. The extent of the damage after nearly a month of attacks is counted in the tens of billions of dollars. Almost all critical infrastructure was either destroyed or severely damaged.

The humanitarian disaster in Ukraine brings with it a migrant and economic crisis for the entire region, the economic impact of which will be felt around the world for years to come. Ukraine is one of the largest producers of cereals and vegetable oils. The production crisis will lead to a spike in prices for the food industry on world markets. This has a major impact on Poland’s economy due to the disruption of supply chains and the almost total lack of business opportunities in war zones. Hundreds of Polish companies in Ukraine have been forced to temporarily close or relocate their businesses and offices.

At present, a comprehensive assessment of the foreseeable impact of the situation on Polish business is probably impossible. Polish investors are left to actively monitor changing regulations, assess the safety of conducting business activities and hope that the war ends as soon as possible.

- General information about the Ukrainian economy (state before the Russian invasion). Expected reforms and changes to business regulations.

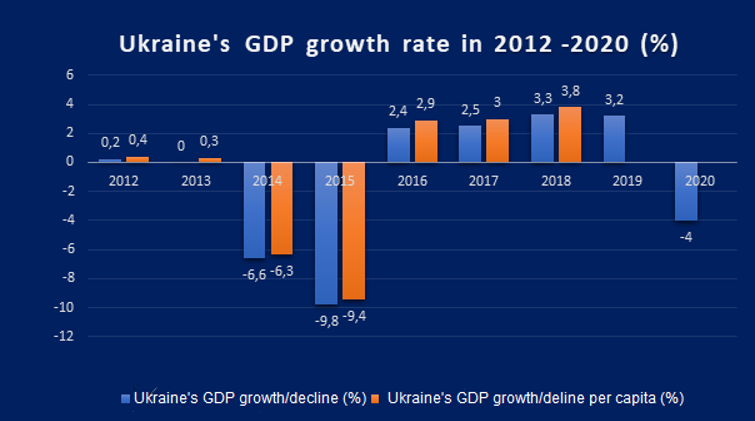

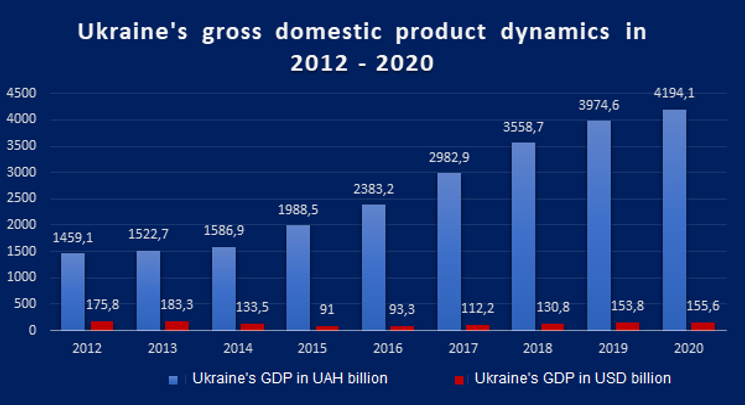

In the first years after gaining independence in 1991, Ukraine was a heterogeneous country plagued by internal conflicts and corruption. The country’s economy regularly faced economic crises, internal power struggles which were not conducive to development and foreign investors’ confidence. It was not until 2014 that the country shifted and chose a Western course for further development which ended in partial Russian aggression. Recent years, however, have seen slow reforms of the judiciary system, a fight against corruption (increasingly successful and producing tangible results), opening more to Western investments and, finally, land reform. The country’s development decisively accelerated after 2018 and even the COVID-19 pandemic did not manage to diminish Ukraine’s very good prospects in the short and medium term.

*Data does not include GDP of occupied Donbass and Crimea, **Source UKRSTAT

*Data does not include GDP of occupied Donbass and Crimea, **Source UKRSTAT

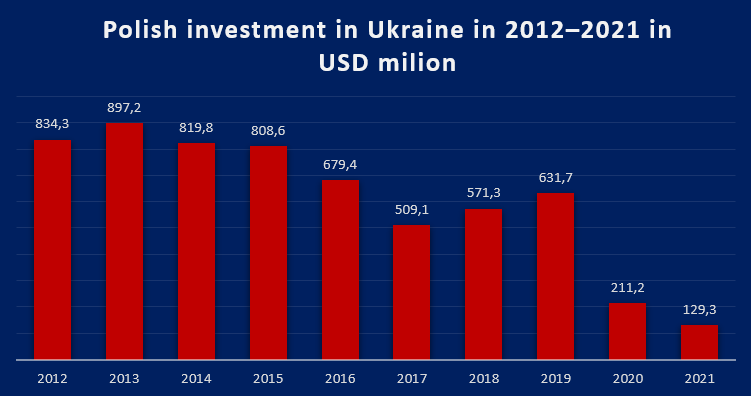

Based on the above data, we can conclude that the Ukrainian economy has been growing slowly but steadily, despite the large expenditure on armaments since the beginning of the war with the Russian Federation in 2014. Another interesting issue is the level and origin of foreign direct investments over the last 10 years. Even before 2015, Russian capital from Cyprus, where it was mostly legalised, was at the top of the list of largest investors. Following the annexation of Crimea, the structure of foreign capital in Ukraine changed significantly. It should be mentioned that in recent years Poland has not only become one of Ukraine’s main economic partners, but the level of Polish investment in the country itself is one of the highest in history and it has been showing an upward trend. It should be noted, of course, that the rate of investment has slowed sharply in 2020 – 2021 due to the restrictions on economic activity caused by the coronavirus outbreak.

*Source UKRSTAT

*Source UKRSTAT

An example of the changes is the “Dia City” bill, which introduced far-reaching changes and tax reliefs for almost the entire IT sector (the bill came into force on 1 January 2022). “Dia City” aimed to develop the entire IT sector, fight against the grey employment market and introduce low and transparent taxes for foreign investors as well as their employees. The main objectives of the bill are as follows:

a) A company that has passed the verification may choose the method of corporate taxation: 9% of dividend tax, or 18% income tax under the general rules.

b) When profits are distributed by a participant in the Dia City programme to a non-resident founder, the tax benefits provided for in international conventions for the elimination of double taxation shall apply regardless of the corporate tax payment system chosen.

c) Preferential taxation of employees:

based on an employment agreement, personal income tax (hereinafter referred to as “PIT”)

– 5% single social security contribution,

– 22% minimum wage for PIT,

– 1.5% military tax,

if an employee’s total remuneration is higher than EUR 240,000 per year, all income above this limit shall be subject to 18% personal income tax.

d) Dividends paid by IT companies to their founders – natural persons (both residents of Ukraine and non-residents) shall be exempt from taxation in Ukraine provided that the dividends are paid no more often than once every 2 years.

- The banking system of Ukraine during the war

The operation of the banking system and the foreign exchange market in Ukraine during wartime is regulated by a resolution of the National Bank of Ukraine of 24 February 2022:

– all banks operating on the territory of Ukraine shall continue to provide their services and operate in their field branches as part of their business,

– banks shall continue to provide both natural persons and companies with access to safe deposit boxes,

– domestic transfers in Ukrainian currency shall be unlimited,

– cash deliveries to ATMs shall takes place without restrictions,

– The NBU shall refinance banks without restrictions to maintain liquidity for up to one year with the possibility of extension for another year.

The relevant resolution also provides for the introduction of temporary restrictions from 24 February 2022, namely:

– suspension of foreign exchange market operations as of 24 February 2022, with the exception of the sale of foreign currency to the bank’s customers,

– UAH exchange rate freeze as of 24 February 2022,

– Limiting cash withdrawals from a customer’s account to UAH 100,000 per day (except for salaries and social benefits), except for enterprises and institutions ensuring the implementation of mobilisation plans (tasks), the Government and individual authorisations of the National Bank of Ukraine,

– prohibiting the transfer of funds from customer accounts in foreign currencies, except for enterprises and institutions ensuring the implementation of mobilisation plans (tasks), the Government and individual authorisations of the National Bank of Ukraine; on 4 March 2022, Resolution No.: N36 of the National Bank of Ukraine lifts the prohibition on the transfer of funds (except for Russian and Belarusian roubles) to residents’ accounts in banks for export transactions.

– introducing a moratorium on cross-border payments in foreign currencies (with the exception of enterprises and institutions ensuring the implementation of mobilisation plans (tasks) and individual authorisations of the National Bank of Ukraine),

– suspension of spending operations conducted through the banks’ operation on the accounts of residents of the country that invaded Ukraine.

On 8 March, the NBU eased restrictions on the foreign exchange market by introducing Resolution no. 44 of the NBU Board of Directors of 8 March 2022. Martial law requires the NBU to gradually ease and clarify the list of restrictions on the foreign exchange market. For this purpose, from 8 March 2022, the National Bank of Ukraine:

– provided banks with the possibility to open accounts for soldiers and to carry out their identification and verification on the basis of a call-up paper,

– enabled customers in areas at risk of occupation by an aggressor state to withdraw cash

in domestic and foreign currency without quantity restrictions, and to purchase cash in foreign currency and precious metals with physical delivery, subject to the availability of cash or precious metals at bank branches. The decision to carry out such an operation shall be made by the General Manager of the bank. The General Manager may also delegate this right to a Branch Manager of the bank,

– established that the prohibition of transactions in Ukraine using the accounts of residents of Russia or Belarus and legal entities whose ultimate beneficial owners are residents of Russia or Belarus does not apply to social benefits, salaries, utilities, taxes, fees and other mandatory payments,

– extended the possibility for residents and non-residents to make transfers to charitable foundation accounts not only in hryvnia but also in foreign currency. This applies to charitable foundations whose purpose and areas of charitable activity are the promotion of defence capabilities and state mobilisation readiness, support of the Armed Forces, territorial defence of Ukraine, social protection, health care and other pressing martial law issues,

– clarified that settlements of documentary and standby letters of credit / guarantees / counter-guarantees granted (confirmed) from 24 February 2022 are prohibited. The NBU made an exception only for the cases of payments for critical imports, settlements with MFIs and other operations of bank customers, the list of which is set out in points 2-6, paragraph 14 of Resolution no. 18 of the NBU Board of Directors of 24 February 2022.

The NBU also decided that the bank may exchange funds in Russian or Belarusian roubles coming from abroad for the purposes of export and import of goods into another currency on the international foreign exchange market and continue to book them on customers’ accounts.

- Settlements with the Ukrainian tax authorities during the war

In Ukraine, a moratorium on penalties related to non-compliance with tax obligations has been introduced for both natural and legal persons, as confirmed by the authorities responsible for assessing emergency situations:

“Ukrainian Chamber of Commerce and Industry confirms that the circumstances of martial law from 24 February 2022 until the official end of the war are extraordinary, unavoidable and objective circumstances for business entities and/or natural persons under an agreement, separate tax and/or other obligations, which were performed in accordance with the terms of the agreement, statutory or other regulations, the performance of which became impossible within the prescribed period due to the occurrence of such force majeure (force majeure).” The occurrence of force majeure is confirmed by the Ukrainian Chamber of Commerce and Industry on the basis of Art. 14, 14-1 of the Law “On Ukrainian Chambers of Commerce and Industry” of 2 December 1997 № 671/97-VR, Statute of the Ukrainian Chamber of Commerce and Industry.

The law exempts taxpayers from financial liability for tax offences and violations of other regulations resulting from force majeure (paragraph 112.8.9 of the Tax Code of Ukraine; CC), provided that the Ukrainian Chamber of Commerce and Industry confirms the occurrence of force majeure. In the case of force majeure, the tax authorities shall not apply penalties if the taxpayer is not able to perform the following actions on time:

- pay taxes and charges,

- file tax returns,

- register tax invoices and calculations of adjustments made to them in the Unified Register of Tax Invoices,

- register excise invoices and calculations of adjustments made to them in the Unified Register of Excise Invoices,

- submit electronic documents containing data on actual fuel residues and volumes of fuel/ethanol traded, etc., but as soon as the state declares the force majeure to have ceased, the taxpayer must fulfil his/her tax obligations.

At the same time, the Government of Ukraine issued an appeal to all companies operating on the territory of Ukraine to make every effort to conduct (as much as possible) normal operations

in order to minimise losses to the Ukrainian economy and supply.

In addition, the Verkhovna Rada of Ukraine passed a law on 17 March 2022 providing for a simplified taxation system for big business, abolishing excise duty on fuel and VAT, exempting private individuals from paying the single social security contribution and more. This was announced by Prime Minister Denys Shmyhal – Law No. 7137-d on the website of the Verkhovna Rada. The document provides for a large number of changes affecting various sectors, as well as small and medium-sized enterprises. This preferential tax regime shall last until the end of martial law.

Fuel taxes: From now on, excise duties on petrol, heavy distillates and liquefied petroleum gas are EUR 0 per 1000 litres. The rate of value added tax on fuel imports has been reduced from 20% to 7%.

Big business will be able to take advantage of the simplified tax system and pay one tax. The annual revenue limit was raised from UAH 10 million to UAH 10 billion and restrictions on the number of employees were lifted. The tax shall be 2% of turnover regardless of the type of business activity. The tax relief shall not apply to businesses involved in the sale of excise goods, the gambling industry and the extraction and sale of minerals.

- The flow of goods and services between Poland and Ukraine.

The Cabinet of Ministers of Ukraine adopted Resolution No. 234 of 9 March 2022 on uninterrupted supply of imported food and feed under martial law. According to the resolution:

– entities operating in the food market who, as a result of military (combat) activities, are unable to comply with the requirements of Art. 10 of the Law of Ukraine “On the Provision of Food Information to Consumers”, may sell food in the customs territory of Ukraine that is labelled in a language other than Ukrainian. However, larger consignments must contain basic information

on the origin and ingredients in Ukrainian;

– foreign humanitarian aid entering the customs territory of Ukraine is completely exempt from the obligation to include a description of the goods in the Ukrainian language.

Under martial law, the government established new rules for the export of a number of agricultural products.

In particular, the resolution prohibits the export of:

– oats,

– millet,

– buckwheat groats,

– sugar,

– salt,

– wheat,

– live cattle,

– pork and beef meat products.

In addition, the Cabinet of Ministers of Ukraine is banning fertiliser exports from Ukraine due to martial law in order to maintain balance in the domestic market of important mineral fertilisers. Thus, a zero quota is introduced for their export. This applies to nitrogen, phosphorus, potassium and compound fertilisers:

– mineral or chemical fertilisers, nitrogen (UKT FEA code 3102),

– mineral or chemical fertilisers, phosphorus (UKT FEA code 3103),

– mineral or chemical fertilisers, potassium (UKT FEA code 3104),

– mineral or chemical fertilisers containing two or three nutrients: nitrogen, phosphorus

and potassium; other fertilisers; goods of this type in tablets, in packages of a gross weight not exceeding

10 kg (UKT FEA code 3105).

This entails a de facto total ban on all exports of the above-mentioned products.

Exports of the following products were allowed under a specific declaratory licence:

– wheat and a mixture of wheat and rye,

– maize,

– domestic chickens meat,

– eggs of domestic hens,

– sunflower oil,

Obtaining a declaratory export licence means allowing the export of a particular good in a limited quantity. All other goods can be freely exported according to the standard procedure.

From the point of view of Polish importers, the restrictions in force will not have a significant direct impact on fertiliser prices. However, it is important to remember that the sanctions imposed on Russia and Belarus will already have a significant impact.

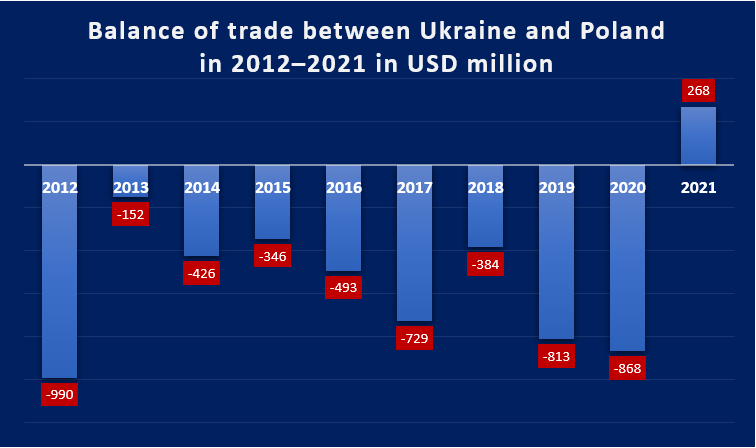

On the other hand, it is obvious that Polish exports to Ukraine are facing a slump; many companies importing Polish goods in eastern and southern Ukraine have been destroyed and some are operating to a limited extent. In the central and western regions of the country, most of the retail chains, distribution, logistics and production companies are operating normally. It should be noted that Poland was Ukraine’s third largest economic partner (after Germany and China).

*Source UKRSTAT

*Source UKRSTAT

- General situation of Polish business in Ukraine

As of 1 January 2022, there were approximately 1,000 companies with Polish capital operating in Ukraine, and the scale of Polish investments in the Ukrainian economy was one of the highest compared to other countries. The largest Polish investments concern the following sectors:

– insurance

– banking

– manufacturing

– construction

– IT

– clothing

– fuel

– pharmaceuticals

– furniture.

For many Polish companies in Ukraine, current events may mean closing their factories, warehouses and offices. A few weeks ago, most foreign companies (not only Polish ones) decided to evacuate key personnel to Lviv in western Ukraine or their home countries. Some companies offered to relocate their employees and their families to other countries and, after martial law was declared, to relocate to areas of western Ukraine.

Many Polish companies with branches in Ukraine also operate outside the country, which means that foreign projects (for men

aged 18-60) are on hold. Only the men who meet the following criteria can leave the country:

– have 3 children,

– are unfit for military service,

– are professional drivers with special authorisation to engage in road transport,

– are the sole guardians of minors,

Some employees also cannot fulfil their professional duties due to being called up for active military service. For IT companies responsible for key infrastructure, there is an option to withhold conscription for 6 months for key employees. However, they still cannot travel outside Ukraine, even temporarily.

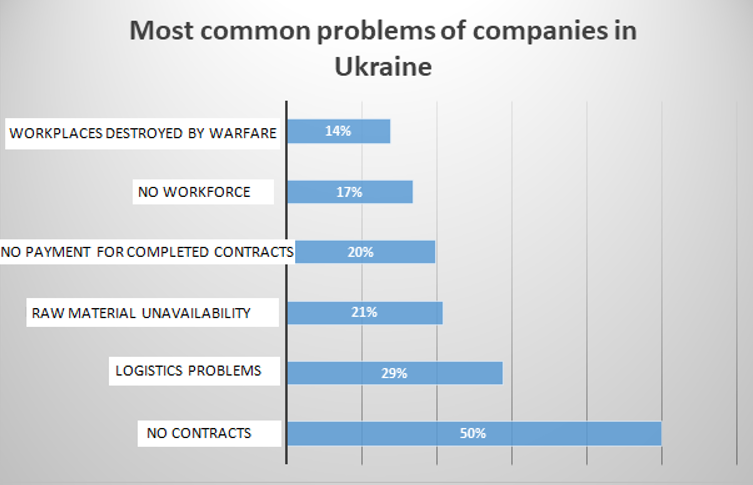

The Kyiv School of Economics hired Gradus Research to conduct a study, which found that because of the war, as many as 85% of companies in Ukraine work part-time or are closed, including:

– 1% of companies have closed and have no plans to restart,

– 35% of companies have suspended operations waiting for better times.

*Source Gradus Reaserch

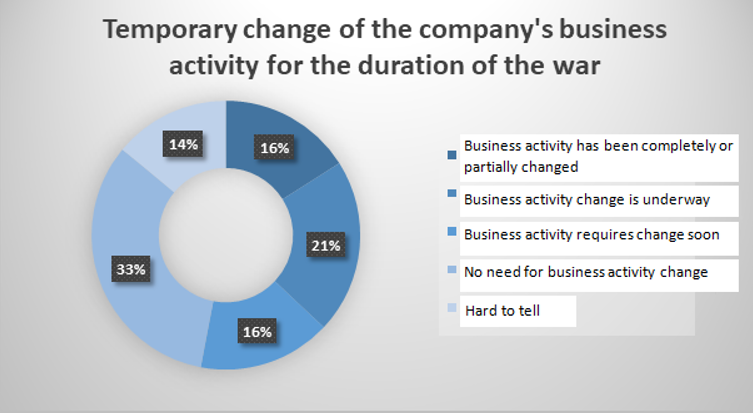

Some Ukrainian companies have decided to change their business activity for the duration of the hostilities, e.g. leading confectionery manufacturer Roshen – humanitarian aid; Carlsberg Ukraine breweries – bottled mineral water.

*Source Gradus Reaserch

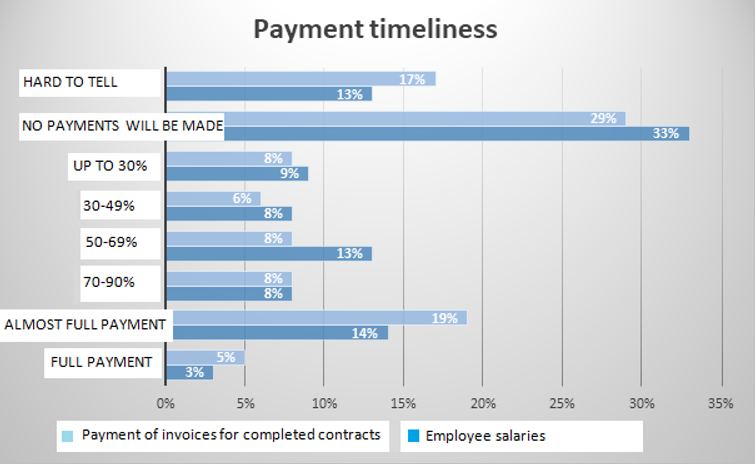

*Source Gradus Reaserch

*Source Gradus Reaserch

To sum up, the situation for Polish business in Ukraine is difficult and deteriorates with every day of hostilities by the Russian Federation. Even at this stage of the war, it will likely take years to rebuild the infrastructure and the economy. Even with substantial financial assistance from Western countries, a return to the past performance by Polish companies is impossible, at least in the short term.

Ukraine is one of the ten most important foreign markets for Polish business; its proximity and untapped potential since the beginning of the 1990s still provide opportunities for development and stabilisation for many Polish companies. It can already be said that a large proportion of Polish foreign investment in Ukraine has been successful. The companies have strong standing, many customers, and in some cases become local market leaders, employing tens or even hundreds of employees. Unjustified aggression by the Russian Federation can destroy the capital built up over many years. With this in mind, we should consider supporting Polish companies that have built up a reputation for Poland as a reliable business partner over the years.

ZPP Newsletter

ZPP Newsletter