Warsaw, 17 September 2021

ZPP’s contribution to the Commission’s consultation on the Vertical Block Exemption Regulation Revision

Background

The current Vertical Block Exemption Regulation (VBER) entered into force on 1 June 2010 and will expire on 31 May 2022 together with the Guidelines on Vertical Restraints. Therefore, the European Commission has started the evaluation process of existing legislation to propose a new, revised version of the VBER. In September 2020, the Commission Staff Working Document was published, outlining the main directions for reform, including the need to adopt the VBER to the challenges related to the growth of e-commerce.

In July 2021, the draft of the revised VBER was published. Our analysis of the draft VBER indicates that, while the revision aims to respond to challenges related to digitization, it will also have major implications for other industries.

Changes in dual distribution and its implications for franchising agreements

Particularly relevant in this context are the changes for dual distribution, meaning a situation where a supplier simultaneously distributes its goods or services directly to its customers as well as through independent distributors, for instance through franchising agreements. Until now, thanks to the VBER, companies exchanging information in a dual distribution system did not have to fear liability for infringement of competition law under Article 101(1) of the Treaty on the Functioning of the European Union (TFEU). However, due to the increased popularity of dual distribution and its possible undesirable effects on market competition, the EC decided to introduce stricter provisions in the revised VBER in this regard.

Changes in the draft revised VBER

The changes can be summarized as follows. First, VBER will not apply where dual distribution leads to “horizontal problems.” To this end, it is proposed to remove the exemption for all cases in which the parties’ combined retail market share exceeds 10 per cent (as opposed to the current 30 per cent). The draft revised VBER provides for an additional exemption, where a supplier and its distributors have a combined market share at the retail level of more than 10 per cent but do not exceed 30 per cent of the relevant market share within the meaning of Article 2(4)(a) or (b) of the VBER. Nevertheless, the exemption for the 10-30 per cent market share threshold will not apply in the case of an exchange of information between undertakings, and such exchange will have to be assessed under the rules for horizontal agreements.

Implications for franchise business model

First, it is important to note that franchising is a popular and important business model, which drives growth and employment in many sectors of the European economy. Franchising agreement are also important for SMEs, providing them with access to know-how and technology.

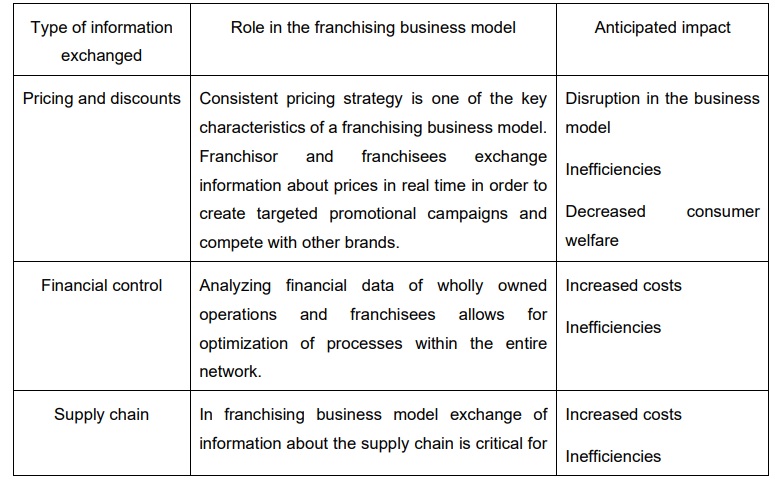

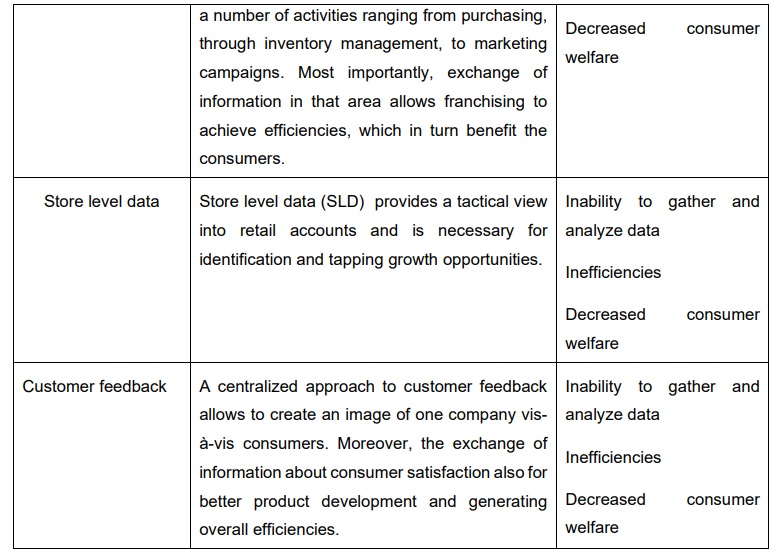

Second, it is essential to understand that exchange of information lies at the heart of the relationship between franchisor and franchisees. In any franchise business model, franchisor and franchisees exchange know-how and commercially sensitive information on every day basis. Franchisees receive access to know-how in return for the access to real time data about local customer demand, when then helps to maintain effective planning and product development.

As it stands, the draft revised VBER prevents or to a great extent disrupts the exchange of information in a franchising ecosystem. Moreover, it requires franchisor to differentiate between wholly owned operations and franchisees, what undermines the idea of the franchising business model.

Keeping the above-mentioned points in mind, it can be seen that proposed restrictions on the exchange of information will require franchisors and franchisees to radically re-evaluate their business models, which can have serious implications for the supply of various goods and services in the EU.

According to the CJEU judgements, any exchange of information that substitutes competition for practical cooperation, should be considered as infringing upon the Art. 101(1) TFEU. Hence, exchange of information between franchisors and franchisees can be impeded in a number of ways. Below we briefly summarize some of the most critical potential changes.

Changes in the treatment of intermediation services and its implications for the marketplaces

Article 2(7) of the Draft VBER withdraws the benefit of an exemption for large parts of vertical relationships entered into providers of intermediary services with their retail activities (“hybrid platform”). Under the new rules, the block exemption will not apply when a hybrid platform enters into agreements with competing undertakings on the retail level. Nevertheless, the block exemption would continue to apply, if competition between two undertakings only exists on the retail level. Therefore, it can be seen that the Draft VBER lead to distortion of competition. Intermediary services providers without their retail businesses will be covered by the block exemption, and intermediary services with their retail businesses will not be covered by the block exemption, while the key criterion used by the Commission to assess who should benefit from the exemption and who should not is the competition with independent retailers on the retail level.

The Commission justifies withdrawal of the block exemption by stating that such agreements affect inter-brand competition and raise horizontal concerns. In our view however this does not justify the exclusion of vertical relationship between intermediary services providers and their retail businesses from the scope of VBER. The Commission should also take under consideration the costs related to this decision. Once the block exemption is withdrawn, the intermediary services providers will have to re-assess all business relationships with their retailers under the horizontal guidelines. The withdrawal of safe harbour will lead to increased transaction costs and increase barriers for SMEs, that use intermediary services providers as distribution channels to access larger pool of consumers. Consequently, proposed changes could harm consumers by leading to increased prices.

Given the above, Art. 2(7) of the Draft VBER will have serious implications for the entire retail industy and will force numerous businesses to re-shape their business models. Therefore, we believe that the Commission should revise Art. 2(7) of the Draft VBER entirely.

Incentives to intermediaries

Paragraph 179 of the Draft Guidelines provides that intermediary services providers may offer incentives to their users to sell their goods or services at a competitive level or to reduce their prices, while resale price maintenance remains prohibited. It is desirable to clarify what incentives would be considered as compatible with EU law and provide examples of such incentives to dispel doubts as to what is a permissible incentive and what is a prohibited influence on the prices charged by users of intermediary services.

ZPP Newsletter

ZPP Newsletter