Warsaw, 17th December 2018

Position of the Union of Entrepreneurs and Employers on the draft act on amending the act on tax on goods and services as well as the act–tax ordinance of 8th November 2018

The Union of Entrepreneurs and Employers has repeatedly emphasised the need for a radical change of the VAT rate matrix. From many expert analyses, including those carried out by the Union itself, as well as from scientific research, it is clear that VAT is one of the most complicated taxes, one causing entrepreneurs the most problems. Testament to it is, among other things, the fact that the National Tax Information is most often asked about the tax on goods and services; from almost 1.5 million replies to taxpayers’ phone inquiries, over 575 thousand concerned VAT. Similarly, more than half of individual tax law interpretations issued in 2017 concerned VAT (13,800 out of over 25,000). The level of complexity of this levy is a result of numerous factors, it is impossible, however, not to notice that one of the main problems regarding VAT – especially from the point of view of entrepreneurs – is the multitude of rates and the hitherto design of its rate matrix.

The VAT rate matrix is currently based on the Polish Classification of Goods and Services (Polska Klasyfikacja Wyrobów i Usług), which in fact assigns very specific types of goods to individual rates, the goods being divided according to certain criteria that difficult to justify. Theoretically, the legislator sought to ensure that healthy, less processed food was covered by a lower tax rate than processed food. Taxation of bread is also based on a similar premise, therefore depending on its shelf-life, for example, tax on toasting bread is higher than that on sourdough bread. Unfortunately, the legislator was not consistent in his intention and, for instance, taxed mustard-based sauces higher than pure mustard. If we add to this examples quite bizarre in their nature, such as preferential taxation of waffles and wafers with a water content exceeding 10% of their mass (8% rate), unlike the other waffles and wafers (regular rate of 23%), the VAT rate system appears to us as illogical, complicated and overly fragmented.

Therefore, the actions of the draft’s authors aimed at far-reaching simplification of this tax should be evaluated as positively as possible. When the first news snippets were broadcast and published in the media concerning the intention to significantly modify the VAT matrix, it seemed that the change would not be of a revolutionary character – the Ministry of Finance simply announced the application of a different statistical classification. However, it is evident in the final draft of the act and the annexes to it that the basic objective, i.e. a radical simplification of the system, has largely been achieved. Thence, it ought to be recognised that this draft act is a step in the right direction, and it should be assessed positively.

The VAT rate matrix proposed by the draft’s authors is much simpler than the one currently in force. This is due to the fact that the individual rates cover a group of goods that is as broad as possible, without fragmenting them and assigning them to specific products, as is the case at the moment. For example, in the current legal status, the rate of 8% covers the following: chili, sweet pepper, mace, cardamom, anise, marjoram, curry, thyme, saffron – almost all are separately mentioned (!), whereas, for instance, for nutmeg, the appropriate rate is 5%. Due to the complexity of the matrix in relation to the spices themselves, in practice, doubts would arise whether individual spices should be taxed at the same rate as mixtures of spices. Spices in the current matrix were also distinguished due to the degree of being processed (for example: raw and dried). Bearing in mind that the discussed problems concern only one and quite a prosaic category of products, it is not surprising that VAT is considered to be the most complicated and problematic levy in the Polish system, and the focus here is still only on rates. In the proposed draft act, specifically the annex to the act on tax on goods and services, all the spices were assigned to the 8% tax rate. There is no doubt that both from the point of view of the practical application of tax law and common sense analysis, this solution is much better than the present state of affairs.

An analogous operation to the one mentioned above was carried out in relation to virtually all categories of goods. This way, the system was significantly simplified and in this context, the actions undertaken by the Ministry of Finance should definitely be praised and supported. The matrix is much simpler and more transparent. At the same time, the authors of the draft emphasise that the changes were not to be fiscal in nature, i.e. they were not intended to increase the budget revenues. One can believe in this statement – the grouping of goods, which until now were simply enumerated to specific rates, into broader categories, is inevitably related to lowering or increasing the tax rate for some of them. It can be argued that a radical simplification of the matrix, and such was proposed by the legislator, is impossible without certain changes in terms of the rates applicable to certain goods. Thus, it should be acknowledged that the discussion about the new matrix should be focused on systemic issues and its simplicity. It is understandable that public attention is focused primarily on the above-mentioned individual rate changes. It seems, however, that in the scale of the average consumer’s shopping basket, these changes basically offset each other, and in any case the difference between the present tax burden and the projected one is of no significance.

As part of the significant changes being introduced by the amendment of the Act, a novelty in the form of binding rate information (wiążąca informacja stawkowa – WIS) is noteworthy. According to the provisions, WIS is to be a decision issued by the director of the tax administration chamber, containing the classification of goods or services and the appropriate applicable VAT rate. WIS is to have a protective value, which means that if the goods correspond to the description contained therein, the tax authority will not be able to question the tax rate applied by the taxpayer based on it. Theoretically, therefore, WIS will be a special kind of tax interpretation, however, due to the fact that the groups of goods assigned to the rates are as wide as possible, its protective impact may be stronger than in the case of interpretations applied presently regarding rates. It is worth noting that WIS will concern not only the matter of the tax amount, but also, for example, the application of the reverse charge mechanism.

However positively do we evaluate the presented VAT matrix design, it should be noted that, in principle, the right approach would be in our opinion the adoption of a uniform tax rate. This way, all interpretative problems with regard to rates would be eliminated (which – and that is beyond any doubt – even despite the far-fetched simplicity of the proposed solution) will still exist, and the legal and tax environment for entrepreneurs would be significantly simplified. The basic argument against this solution, which is raised in the public debate, is the allegedly devastating effect of the uniform VAT rate on household budgets, especially of the least wealthy households. It seems, however, that this is a statement with no confirmation in reality.

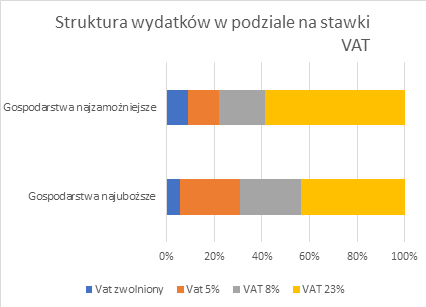

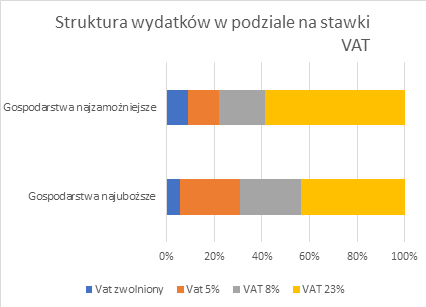

According to the CenEA report published in 2015[1], household expenditure broken down into VAT rates corresponding to expenditure that was different for households classified as the poorest and for wealthy households. In the poorest households, the share of expenditures on goods and services exempt from VAT was lower (6% against 8.9% for the wealthiest households), as well as the share of expenses related to the VAT rate of 23% (47.8% against 58.7% of the wealthiest households). The explanation of this phenomenon is a larger share in the budget of poorer households of expenditure on basic goods, such as food, which are often subject to a VAT rate of 5%. On the other hand, wealthy households more often make use of services exempt from VAT, such as medical or educational services.

Another structure of VAT taxation of the so-called “basket” of goods purchased by poor and affluent households requires an answer to the question of what is the “average” VAT rate paid by households. On the basis of the data already quoted, the “average” VAT rate for the poorest households can be set at 14.7%, and for the most affluent at the level of 15.7%. The results confirm, therefore, that the current system of VAT rates means that the expenses of the poorest households are on average less subject to VAT, but this difference is not significant. This weakens the argument that reduced VAT rates are an important support factor for poor households.

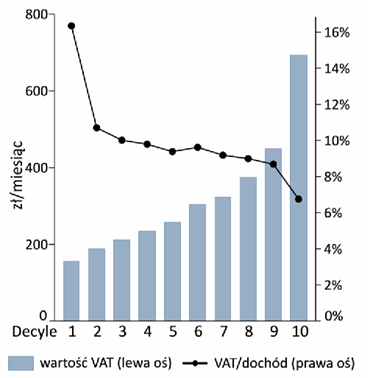

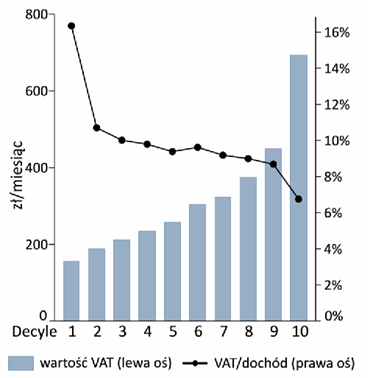

In addition to the analysis of the average VAT rate, it should also be examined how much of a burden this tax is for the household budget. To this end, households were divided in terms of affluence into 10 groups, creating a decile distribution. According to the available data[2], VAT expenditure amounts to just over 16% of the income of the poorest households (first decile), then this value for 8 consecutive deciles is in the range of 9-10.5%, whereas for the last decile (the most affluent households) it comes down to approximately 7%.

Taking into consideration the presented distribution and earlier analyses concerning the average VAT paid, it can be assumed that just about 10% of all households would be affected by the introduction of a uniform VAT rate most severely.

In the discussion on the possible introduction of a uniform VAT rate, it can be noted that the proposed levels of the single rate are quite convergent and most often in the range of 15.5-17%. For example, in January 2015, the chief economist of the Ministry of Finance, Ludwik Kotecki, stated that a uniform VAT rate could theoretically be considered at the level of 16-17%[3]. At the same time, Sławomir Horbaczewski said that a rate within the limits of 15,5-16%[4] would be neutral from the point of view of budget revenues. One can also think of a number of journalistic and political statements, which also suggest varying VAT rates from the indicated range. Taking into account the previously presented data and the fact that the EU requires a rate of at least 15%, such an amount should be accepted as an alternative to the current system.

The introduction of a uniform VAT rate at the contractual level of 15-16% would therefore have, cæteris paribus, a slight impact on household budgets.

To sum up, the presented draft act should be assessed positively as one that is significantly simplifying the system, while recommending the adoption of a uniform VAT rate as the optimal solution.

Union of Entrepreneurs and Employers

[1] http://www.cenea.org.pl/images/stories/pdf/commentaries/raport1_vat_2.pdf

[2] http://www.cenea.org.pl/images/stories/pdf/commentaries/raport1_vat_2.pdf

[3] https://finanse.wp.pl/vat-16-proc-jednolita-stawka-najlepsza-6114855497205889a

[4] https://www.rp.pl/Opinie/303069902-Jednolita-stawka-pomoze-uzdrowic-VAT.html

ZPP Newsletter

ZPP Newsletter

Recent Comments