Warsaw, 6th April 2021

Memorandum of the Union of Entrepreneurs and Employers: A uniform 5% VAT rate – rescue for the food services industry and small cost for the budget

For months, the Union of Entrepreneurs and Employers has been proposing to introduce a uniform 5% VAT rate for the entire food catering industry. Contrary to public opinion, the essence of this change is not the idea to increase the demand for these services by lowering prices. A lower VAT rate would benefit restaurateurs whose activities would become much more profitable after re-opening, which would in turn enable them to recover in spite of a lower turnover.

We believe that the discussed instrument might not only prove effective, but also – in terms of expenditure to save the economy – cheap. The estimated costs of its introduction quoted at the level of PLN 1.2-1.5 billion in the ongoing discussion refer to budget revenues from VAT in this industry in 2019, therefore this value is at present completely aberrant. With this in mind, we prepared our own econometric analysis of the real cost of implementing this highly particular reform. Depending on the assumed turnover decrease in the food services industry in 2020 (official data has not yet been published), this cost may range from PLN 350 to 700 million, with the average value being approximately PLN 500 million. Our detailed analysis is presented below.

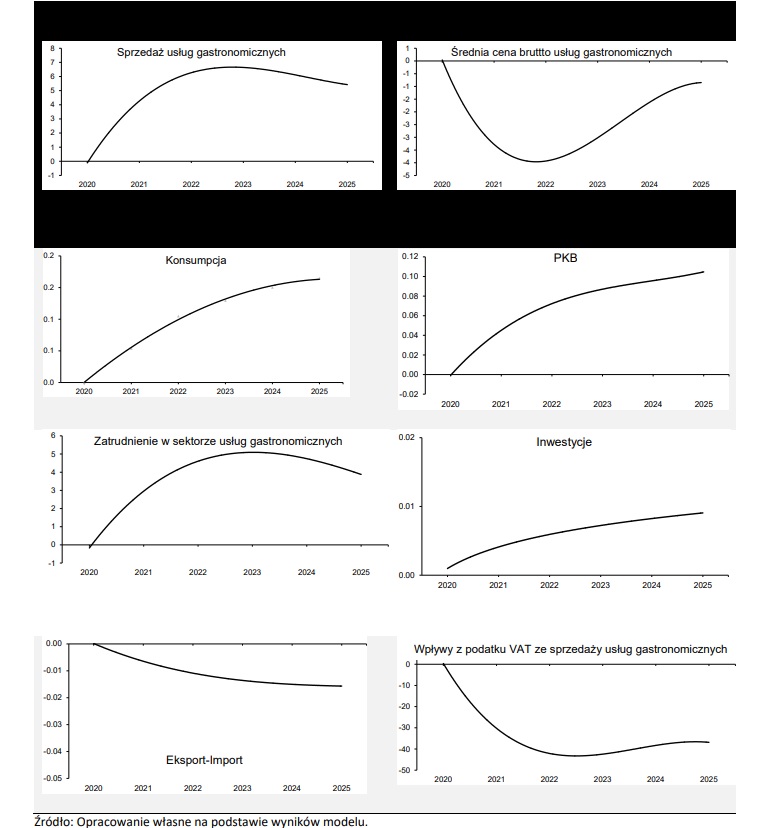

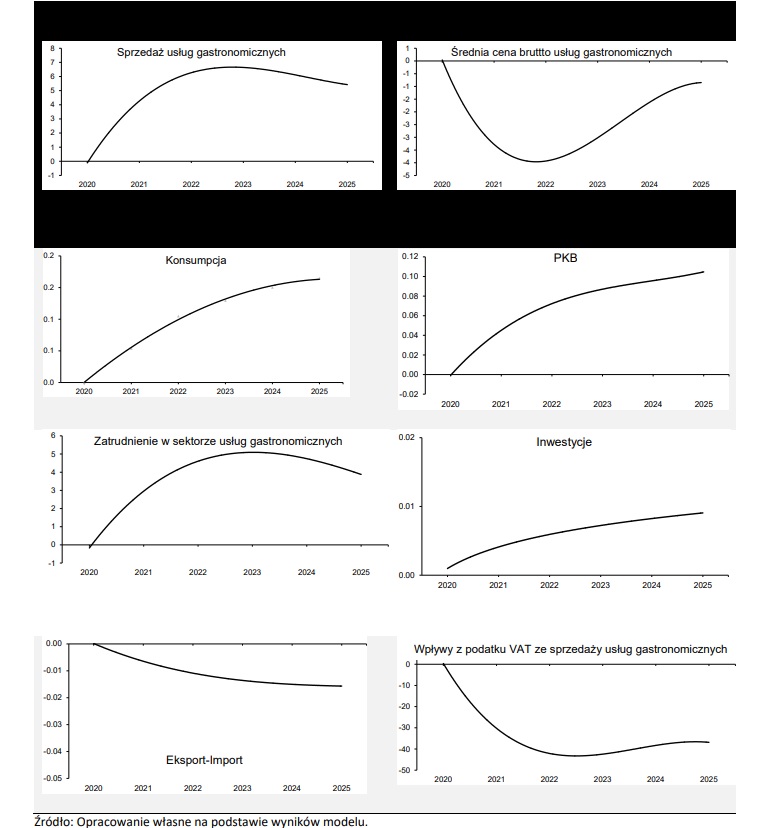

To measure the additional positive macroeconomic effects of the reduction and unification of the VAT rate on food catering services, we propose a dynamic Keynesian, open-economy model, with two sectors – extended by distinguishing food catering services from other consumer goods. The input for the volume of revenues in the former sector are the data of Statistics Poland (Poland’s central statistical office), Local Data Bank, and revenues from activity related to food services in 2019 (Chart 1). On their basis, VAT revenues and the weighted effective VAT rate were estimated, taking into account the revenue from the sale of commercial goods, the revenue from catering production, the revenue from the sale of alcoholic beverages and tobacco products, as well as other activities.

The forecasted scenario is a shock to the effective VAT rate for catering services imposed in mid-2021.

The effects of introducing a uniform 5% VAT rate

Increase in sales of food catering services: +6,62%

Average change in gross price of food catering services: –4,36%

GDP growth: +0,10%

Household consumption: +0,16%

Budget revenues from VAT for catering services annually: PLN –0.713 billion (assuming a 40% decrease in revenues in 2020) / PLN –0.534 billion (assuming a 55% decrease in revenues in 2020) / PLN –0.356 billion (assuming a 70% decrease in revenues in 2020)

A reduction of the VAT rate, being an element of mitigating the negative sectoral effects caused by the decrease in sales caused by the lockdown and deteriorating consumer sentiment, impacts the economy in three ways. First of all, in 2022, consumption and GDP rise (0.16% and 0.10% respectively) as a direct effect of the decrease in the gross price of food catering services by 4.32% and the increase in sales of catering services by 6.62% annually. Next, the negative effects of the crisis on employment in food catering services are mitigated which is particularly important from the perspective of maintaining a relatively good economic situation. The VAT reduction proposed in the analysis raises the level of employment in the catering services sector by 4.85% in 2022 (Chart 1). And lastly, the income effect. It results from surplus cash available to households, as taxation on their consumption decreases. As a consequence, we observe an increase in consumption of other goods and an increase in household savings, which later translate into a slight increase in investment in the economy (0.01%).

Chart 1. Dynamic presentation of the impact on macroeconomic variables induced by the introduction of a uniform 5% VAT rate for food catering services from mid-2021 [Percentage changes in variables compared to the reference level].

Observing the dynamics of these variables over the course of the first years of the shock, we see a strong increase in employment and sales of food catering services. They are a result of the relatively high flexibility of the demand for such services. This value ranges from 0.8 to 1.5, and the value for Poland adopted for the purposes of the analysis is 1.157 (cf. Grotkowski, 2018).

As a result, in this particular sector, the proposed VAT reduction is a very effective tool in the short-term fight against the decline in demand due to the lockdown and deterioration in consumer sentiment. In the longer term, the average gross price of food catering services starts to rise, and then stops at a lower level than before. We see the reflection of the subsequent price increase in the subsequent upward trend following the decline in VAT revenues from the sale of food catering services.

Furthermore, it is rather noteworthy that the unification of the VAT rate will also contribute to the simplification of the whole VAT system and will positively affect it in terms of simplicity and transparency. This in turn will significantly contribute to the improvement of business conditions in the food catering services sector, which are an important group of micro-, small and medium-sized entrepreneurs. Taxing all catering services with a uniform VAT rate will facilitate the use of tax law and the correct application of its provisions in economic practice, and will thus eliminate possible abuse in this area.

See more: 06.04.2021 Memorandum of the Union of Entrepreneurs and Employers: A uniform 5% VAT rate – rescue for the food services industry and small cost for the budget

ZPP Newsletter

ZPP Newsletter

Recent Comments