Warsaw, 22nd June 2021

Opinion on demography of the Chief Expert of the Union of Entrepreneurs and Employers on Political Economy

It has been known for more than a dozen years that Poland is at risk of a demographic tsunami. Pursuant to that, the Union of Entrepreneurs and Employers has touched upon this subjects numerous times. The drastic decrease in fertility rate and the (quite obvious) dramatic decrease in the number of births accompanying it began in the final years of the Polish People’s Republic and lasted at least until the beginning of the 21st century. This decrease and the subsequent stabilisation of the number of births translate into the fact that nowadays almost 2 times fewer children are born than in the early 1980s and approximately 30% less than at the threshold of the economic transformation. The time of the pandemic has shown how important a factor influencing the decision to parentage today is the issue of confidence and security. That period of uncertainty at the beginning of the pandemic brought about a sharp – though probably temporary – drop in births (an interesting case that remains to be seen is whether the next waves of the pandemic or how the right to abortion was exploited in the current political disputes will also affect the number of births this autumn).

Furthermore, the high migration wave after the accession to the EU brought about serious consequences. Although Poland has almost always been a region people migrated away from, the last wave of emigration has contributed to the deepening of the growing birth crisis. For a short period, politicians accepted it with a feeling of relief, as it resolved tensions on the labour market at the beginning of the 20th century. This way, however, a significant part of the last numerous generation of Poles decided to leave the country forever, and often also to have kids abroad.

The declining pressure on the labour market, as well as the decreasing burden on the education system were viewed as benefits, or at least not as threats. After the problems on the labour market from the 1990s, Poland entered a period when it simultaneously benefited from European integration and a demographic premium (a decrease in the demographic dependency ratio resulting from decreasing cohorts of children and still small cohorts of retirees). The outflow of migrants helped further, relieving another of the costly welfare state systems: unemployment benefits. Economic growth was fuelled by the inflow of European development funds and the unchanging relatively low labour costs. However, as time passed, that demographic premium began to lose its significance and the cost of functioning of the state began to rise. Today, it is evident that we are on the verge of a major demographic crisis.

It is also worth adding that the actual fertility rate in Poland is difficult to determine – which is surprising, because the knowledge of what it really is should be the foundation of modern evidence-based policy (EBP). The above-mentioned wave of pre- and post-accession emigration is not properly registered in official statistics. As a result, in the calculation of the total fertility rate (TFR), we do not know the precise divisor. Many women aged 18-30 left Poland between 2004 and 2011, most probably never to come back. This generation still determines the Polish TFR. A fertility rate, in which the absence of a significant group of women in Poland is ignored, is certainly underestimated. And who knows by how much – is it 5, 10 or more percent? (Independent estimates put that number between 5 and 10%.) In fact, the administration, as well as all of us, are not able to compare the fertility level of Poland and – for example – Hungary, Slovakia or Austria. We only know what the situation looks like superficially.

And the situation of Poland is not an exception to the rule – a decline in the TFR below replacement-level fertility is a problem for the entire developed West, and Europe in particular. And some countries begin suffering from it too early, or at least quicker than the developed countries of the West – before they become wealthy enough and stabilise their prosperity. This is being said about China, but Poland and South Korea are equally good examples. Economic success translates into a decline in fertility rates, and the demographic premium is replaced by growing burdens from the growing cohorts of retirees. Labour costs followed by a workforce shortage grow regardless of productivity increases (because the labour market becomes unequivocally and fully the employee’s market). If there are no good solutions, the demographic crisis will translate into a decline in labour supply (actually, the symptoms of this problem are already visible, see below) and – with a high probability – a loss of competitiveness, and, consequently, a slowdown in economic growth and convergence processes with Western economies. One may hope that the increase in productivity will compensate for the decline in workforce, but this is most probably a false hope.

The economy is already feeling the falling labour supply. Admittedly, ministers are proud to report that we have passed the pandemic crisis safe and sound also with regard to unemployment. But I believe that the very low unemployment at the end of a deep crisis is not so much due to great aid and anti-crisis programmes, but rather is a serious warning bell that problems with labour supply are on the rise. The still low productivity of the Polish economy is compensated by the low level of wages and the availability of a (cheap) labour force. It looks like this model of economy is coming to an end, but unfortunately the structure of the economy changes more slowly than the demographic structure. This is due to one unexpected factor.

In recent years, Ukrainians and Belarusians have come to aid the Polish economy, seeking, like we had a few years earlier, a better life and a more normal world. They turned out to be a bit of an unexpected rescue – for employers, for the economy, for economic growth, and therefore (indirectly) for the government. However, unlike in the case of policies of many Western countries, it is difficult to indicate any action of government to encourage them to stay. All the while these are immigrants who are culturally close to us, who will potentially easily integrate with us, and are competent and educated. Many speak Polish well. It will be difficult to find “better” migrants in the future…

For the past dozen or so years, since the future consequences of growing demographic programmes have become more and more obvious, increasingly bold attempts have been made to remedy them. Tax breaks for parents as well as a large family card were introduced. The last of these attempts is the 500+ project, a financial support mechanism for people with children, which is also intended to be a stimulus to have children. However, quite quickly, even in official statements, the goal of this project began to evolve – and it became a symbol of the effective(?) social policy of the ruling party, Law and Justice. The topic of demographic or pro-family policy has been returning several times, for example when extending the 500+ programme to the first child. Thus far, regardless of official propaganda, all attempts have produced moderate results. The increase in the number of births after the introduction of 500+ from today’s perspective should be interpreted as an effect of accelerating the decision to have a child, and only to a small extent as an actual increase in the number of births. However, in order to find out the actual effects of the programme and the current fertility rate, it would be necessary to determine the actual number of women of childbearing age – hopefully the ongoing Census will help (and if it does not help, why do we need one at all?).

And only in this context, one must look at the new ideas of demographic policy in the Polish Deal. Unfortunately, they often boil down to promises regarding pro-family policy – as unwise as they are often redundant or long late considering the current situation on the labour market (such as incentives to create nurseries in each gmina, or commune). Basically, however, financial incentives (caring capital) are to be supplemented and a few privileges are to be added, which raises the question of why they are addressed only to families with children. Maybe the amount of 500+ will also be indexed.

Up until now, similar instruments have worked poorly (although no one intends to seriously conduct evidence-based policy and check which instruments are truly effective and only then support them). Perhaps, then, we need to look more actively for better solutions? Interestingly, politicians see the low effectiveness of the current policy and accept it with a certain amount of indifference or melancholy.

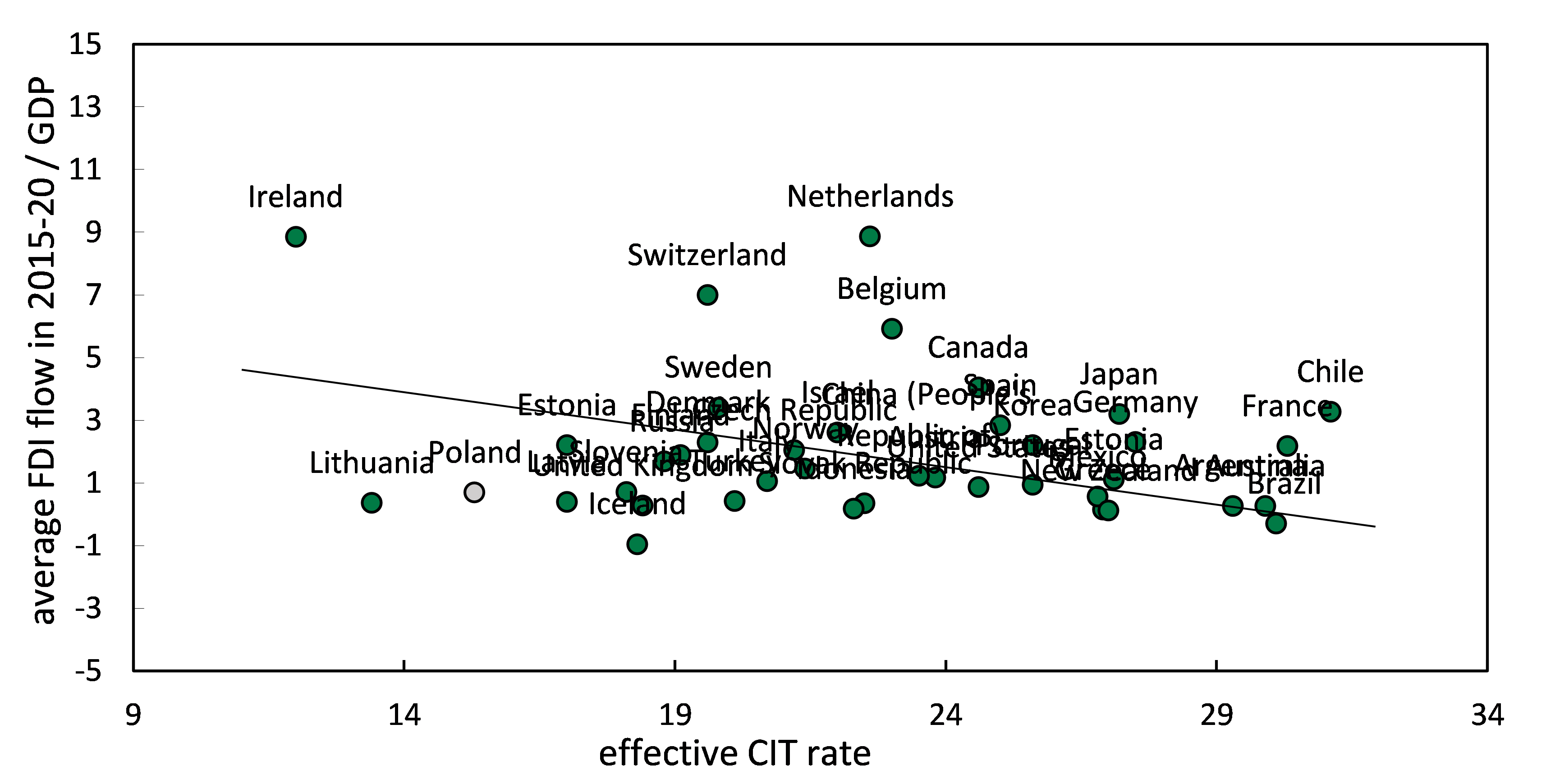

If we want the “golden age” of Poland’s development to last for the next years and decades (and this is what Law and Justice politicians are promising us), then we need an effective pro-family policy. And apart from the costly, but important and necessary (as long as they are properly designed) demographic policy programmes, we are also in need of a well-thought-out emigration policy. Two promises were made in the New Deal with regard to this. One empty and devoid of content: Poland will become an attractive country for specialists, thanks to government support mechanisms. And these specialists will pay taxes in Poland, not because it will be financially attractive, but because we will offer a better quality of life, conditions for integration, and security. The current level of salaries in Poland, the quality of public institutions (compared to our Western neighbours), and often the manner of conducting internal and international policies do not add any credibility to these words. Especially if it were to be supplemented with the second idea from the New Deal: a tax relief for returning emigrants (most probably, it will not have extravagant results either). And if, from their perspective, returns need to be made more attractive, then how can we expect that the same legal and tax order will be attractive for immigrants?

Much criticism has been directed towards “the gang in power”. I do not agree with all of it. However, one of their greatest sins will be the neglect of policies on family, demographics, and migration, because they may (though hopefully not) weigh on the next decades of Poland’s development.

Piotr Koryś, Ph.D.

Chief Expert of the Union of Entrepreneurs and Employers on Political Economy

ZPP Newsletter

ZPP Newsletter

Recent Comments